Parent PLUS Loans provide an excellent way for a parent to help their child pay for college. But when it comes time to start making payments, it can be challenging, especially with other competing financial goals.

If you’re trying to figure out how to pay off Parent PLUS Loans early or more effectively, there are several options to consider. Here are some ways to consider approaching yours.

How paying off Parent PLUS Loans can help your financial life and goals

As a parent with a college-age child, you may be in your 40s, 50s or even 60s. This means that in addition to paying off your student loans, you may also be working on saving for retirement, covering ever-increasing health care expenses and more.

Unfortunately, your Parent PLUS Loan payments may be making it difficult to make meaningful progress with those other important financial goals, let alone get by with your current needs.

If you can find a way to pay off your loans early, that’ll free up more cash flow to allocate toward other important expenses and goals. If you’re struggling to get by on your current budget, though, prolonging your repayment term to get a lower monthly payment may be a better path forward.

Did you know? Parent PLUS Loans often have the highest rate of any federal loan.

Over the past 5 years, Parent PLUS Loans have had an average rate of 6.7% — but refinance rates currently start at a historic low 1.88%.

Takes 2 minutes • No impact on credit

Either way, being proactive about your student loans can make a big difference for your situation and make for a better financial future.

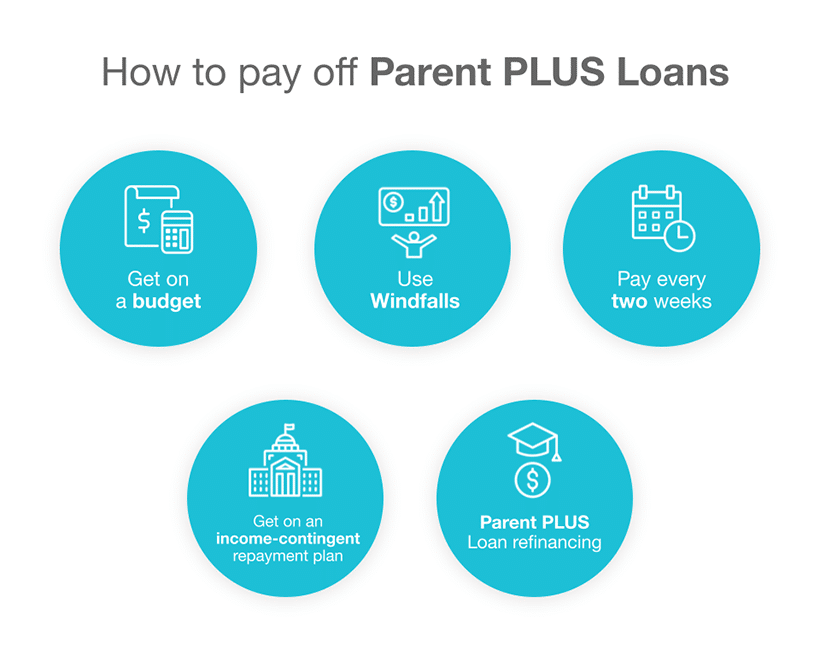

How to pay off Parent PLUS Loans

Depending on your situation, there are several ways you can tackle your student loans and meet your goals with the debt payoff process. Here are five tips that can help.

- Get on a budget: Creating and sticking to a budget is one of the best ways to achieve any financial goal because it helps you understand where your money is going every month. If you can identify and cut back on some of your discretionary spending, you could reallocate those funds toward your debt payments.

- Use windfalls: Every time you get a bonus from work or a tax refund, consider using a good portion — or even all — of it to pay down your student loan debt. Making large payments like this won’t reduce your monthly payment, but it can significantly reduce how much interest you pay and cut months off your repayment schedule.

- Pay every two weeks: Instead of making just one payment every month, pay half of your monthly payment every two weeks. By doing this, you’ll end up making 13 months’ worth of payments in a year, cutting some time off your term.

- Get on an income-contingent repayment plan: Parent PLUS Loans aren’t eligible for most income-driven repayment plans. But if you consolidate your loans through the federal government, you can get on an income-contingent repayment plan. This won’t help you pay off your bill faster, but if you’re struggling to keep up with payments, it can reduce your monthly payment, giving you some more breathing room.

- Parent PLUS Loan refinancing: Refinancing your Parent PLUS Loans can open the door to many different benefits, including lower monthly payments, faster repayment, lower interest rates and more.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

How to refinance Parent PLUS Loans

Parent PLUS Loan refinancing can be one of the best ways to pay off your student debt more quickly. Some of the benefits include:

- Lower interest rates: Depending on your creditworthiness, you may qualify for a lower interest rate than what you have now. This would not only decrease your total interest costs but could also reduce your monthly payments.

- Payment flexibility: You can opt for a longer repayment term with Parent PLUS Loans, but there’s no option to shorten your schedule. With Parent PLUS Loan refinancing, you can replace your current loans with a new one with terms ranging from five to 20 years, or sometimes longer.

- Transfer your debt: If your child has graduated and is willing to transfer your student loans to their name, Parent PLUS Loan refinancing is the only way to do that. If you can accomplish this, you’ll be able to get rid of your student debt entirely, making room in your budget for other financial goals.

It’s important to note, however, that not everyone qualifies for Parent PLUS Loan refinancing. Even if you do, there’s no guarantee you’ll get the terms you’re hoping to get.

How to refinance Parent PLUS Loans at the lowest rates

Refinancing involves replacing your current loans with a new one through a private lender. The process starts with prequalification, which allows you to see which offers are available based on your credit profile. Prequalification doesn’t require a hard credit check, so it doesn’t impact your credit score.

With Purefy’s rate comparison tool, you can get prequalified with and compare several lenders in one place. The more lenders you view, the easier it will be to find the lowest interest rate available based on your financial and credit situation.

Once you’ve found the right lender for you, submit an application to get a final offer and proceed with the refinancing process.

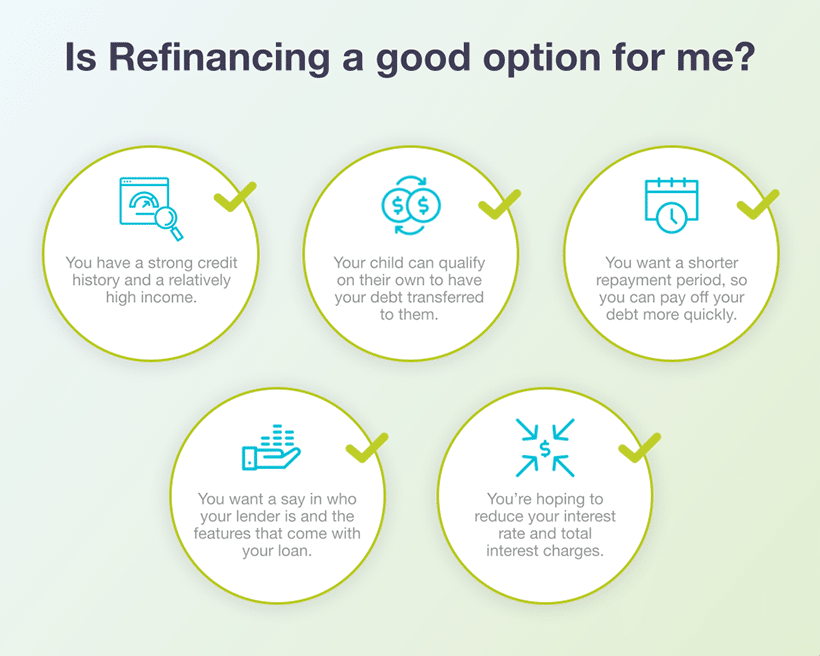

Should I refinance Parent PLUS Loans?

Remember, if you’re trying to figure out how to pay off Parent PLUS Loans, refinancing may be one of the best ways to accomplish your goal. That doesn’t mean it works for everyone, though. Consider Parent PLUS Loan refinancing if:

- You have a strong credit history and a relatively high income.

- Your child can qualify on their own to have your debt transferred to them.

- You want a shorter repayment period, so you can pay off your debt more quickly.

- You want a say in who your lender is and the features that come with your loan.

- You’re hoping to reduce your interest rate and total interest charges.

Even after you refinance, you can still use some of the other tips we’ve provided for paying down your debt faster. Even with the best approach, paying off your student loans can take years. But the more focused you are over time, the more time and money you’ll save as you near your goal.