In 2020, the House of Representatives passed the Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act to help people deal with the economic impact of the coronavirus pandemic. The HEROES Act contained a significant measure for student loan borrowers: the cancellation of up to $10,000 in federal or private student loan loans if the borrower is economically distressed.

Why was this such a big deal? While federal student loan forgiveness has been an option for borrowers in the past through programs like Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and even income-driven repayment plans, private student loan forgiveness has never been available before.

Free eBook: How to Conquer Student Loans

Free eBook: How to Conquer Student Loans

However, private student loan relief — such as the forgiveness stipulation within the HEROES Act — has to pass the Senate before it can become available to borrowers. Private student loan forgiveness has a slim chance of passing in any capacity, so you shouldn’t count on private loan relief for your debt.

Did you know? Refinancing can help you repay private student loans.

Refinancing private student loans gives you the ability to save money with a lower rate, and customize your repayment term to fit your goals.

Takes 2 minutes • No impact on credit

If you need help with your private student loans, here’s what you can do instead — without hoping for forgiveness which is highly unlikely to occur.

Why doesn’t student loan forgiveness include private loans?

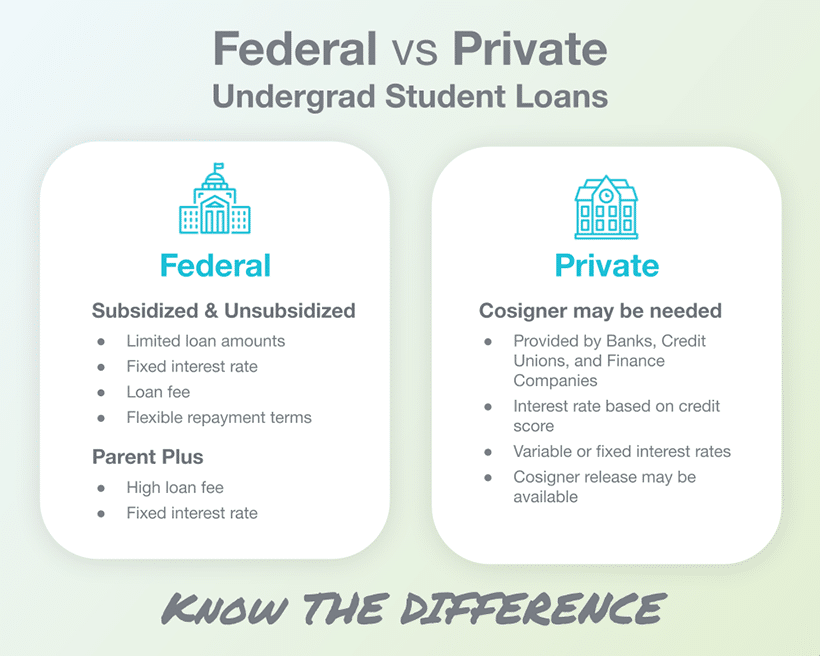

With federal student loans, the U.S. Department of Education acts as your lender. Under loan forgiveness programs like PSLF, the government absorbs the cost of discharged loans for qualified borrowers and handles the administrative burden.

Private student loans are more complicated. Instead of having one central lender, private student loans are issued by individual banks, credit unions, and other financial institutions. Each company has its own shareholders and loan servicers to satisfy. Any effort to pursue private student loan forgiveness would require billions of dollars from the government to pay back all the private lenders.

In the past, Republican leaders have not been favorable toward loan forgiveness efforts. In response to the latest effort with the HEROES Act, Senate Majority Leader Mitch McConnell declared it “dead on arrival,” signaling how difficult a path forward loan forgiveness has.

Read More: Private Student Loan Forgiveness: Where Art Thou?

Private student loan forgiveness alternatives

Private loan forgiveness is unlikely to happen any time soon. If you’re struggling with your debt, consider these alternatives to manage your loans.

1. Refinance your student loans

If you want to supercharge your debt repayment, consider refinancing your student loans. With this approach, you apply for a loan with a private lender for the amount of your existing debt. Your new loan will have different terms than your old ones, including interest rate and monthly payment.

Refinancing private student loans to a lower rate is often a no-brainer!

If you can qualify for a lower interest rate by refinancing private student loans, you can save big without any major drawbacks.

Takes 2 minutes • No impact on credit

2. Contact your lenders about hardship options

If you can’t afford your current payments because you lost your job, are facing a medical emergency, or have some other financing hardship, contact your lender right away. Some private student loan lenders offer emergency forbearance or alternative repayment programs to give you some relief.

For example, Ascent may grant you forbearance for one to three months at a time, for a maximum of 24 months over the life of your loan.

3. Research state loan repayment assistance programs

While you aren’t eligible for loan forgiveness, you may qualify for repayment assistance through your state. Some states will repay a portion of your debt if you work in certain professions and make a service commitment.

For example, healthcare professionals in Kentucky can qualify for up to $80,000 in student loan repayment assistance in exchange for two years of working in a high-need area.

Check with your state department of education to see if there is a similar program for your career.

4. Ask your employer about loan repayment benefits

More employers are offering student loan repayment benefits as a recruitment and retainment tool. According to the International Foundation of Employee Benefit Plans, 4% of responding organizations offered student loan benefits, and 23% of organizations were considering implementing benefits in the future. In many cases, they function like a retirement plan; the employer will match a portion of your student loan payments, up to a percentage of your salary.

Ask your human resources department if there is a student loan repayment program in place. If not, you can suggest that they start one to attract and keep top talent.

5. Boost your income and make extra payments

To pay off your debt faster, look for ways to increase your income. If you use the extra cash to make additional loan payments, you can save a significant amount of money by paying less in total interest.

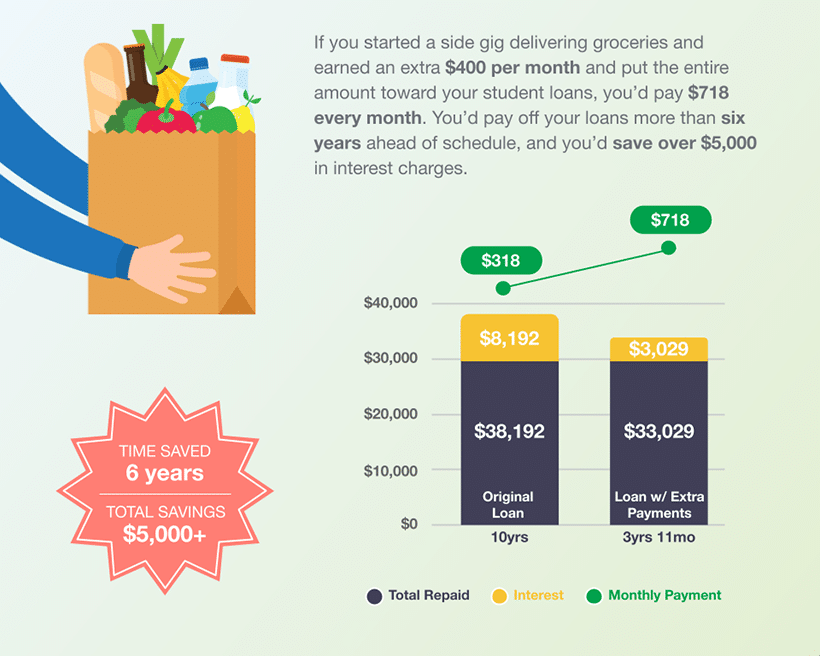

For example, let’s say you have $30,000 in student loans at 5% interest. With a 10-year repayment term, your monthly payment would be $318. Over the course of your repayment, you’d pay a total of $38,192.

If you started a side gig delivering groceries and earned an extra $400 per month and put the entire amount toward your student loans, you’d pay $718 every month. You’d pay off your loans more than six years ahead of schedule, and you’d save over $5,000 in interest charges.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees