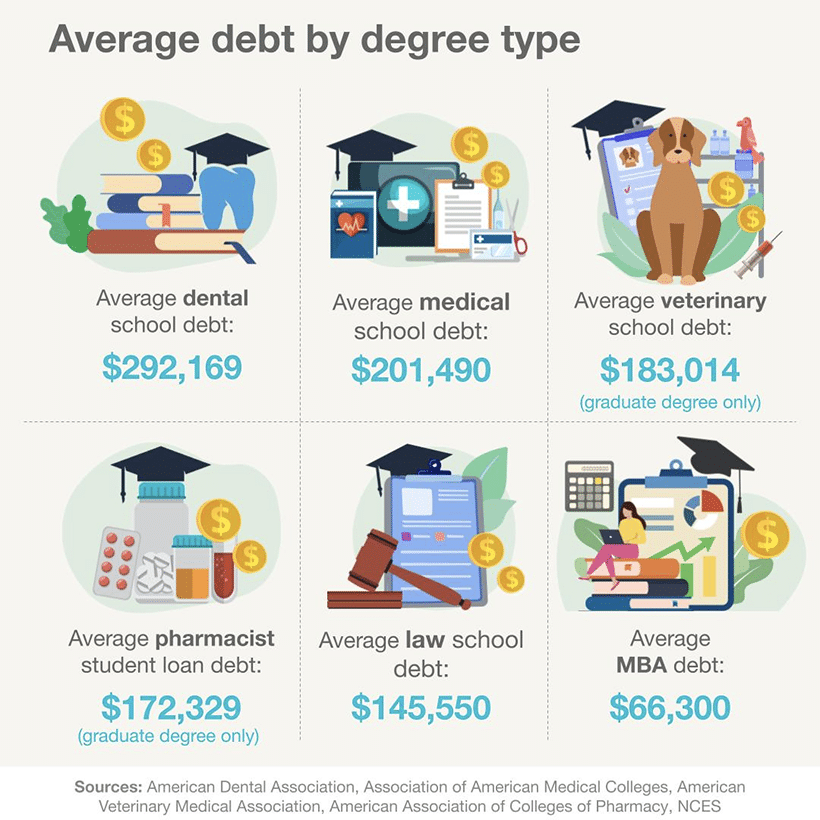

On average, student loan borrowers graduate with $29,650 in student loan debt. But college graduates with six-figure balances aren’t uncommon, especially in the medical and legal fields.

Figuring out how to pay off $100k in student loans, $200k in student loan debt, or even more can be challenging, but some repayment strategies can help you achieve your goal. While the standard repayment term for federal loans is 10 years, it takes anywhere between 13 and 20 years on average to repay $100k in student loans.

Here are some different scenarios to consider, depending on your financial situation and goals.

How common is it to have over $100k in student loans? What about $200k in student loan debt?

Currently, the average student loan balance per borrower is $29,650 — but it’s definitely a common problem to have much higher student debt in the six figures.

The likelihood of having $100k to $200k in student loans often depends on a number of factors including:

- How much you initially needed to take out in student loans to fund your college education (how much savings did you already have, how much federal aid did you receive, did you have financial support from family, did you get any scholarships or grants, etc.)

- The number of years you stayed enrolled in school

- The type of degrees you achieved (associate, bachelor’s, master’s, doctorate)

- The type of program you enrolled in (medical, nursing, law, business, etc.)

- The type of university or college you attended (private, public, in-state, out-of-state, etc.)

Often, those who stay in school longer to pursue advanced degrees at more expensive private universities are the people more likely to have higher student debt and be interested in how to pay off $100k in student loans or $200k student loan debt.

How long does it take to pay off $100k in student loans? How about $200k in student loan debt?

Paying off $100k in student loans or $200k in student loans depends almost entirely on two things:

- Your current student loan repayment plan

- How much extra money you have to devote to your student debt

If you have a standard 10-year repayment plan, your debt will be paid off in full in 10 years — if you don’t pay extra toward your principal or change your repayment plan.

However, there are a number of repayment options you can choose to either pay off your loans faster or lower your monthly payment.

For example, if you have federal student loans, you can opt for an income-driven repayment plan which drops your payments but extends your repayment term — causing you to take about 25 years to be debt free.

Or, if you have private student loans or a combination of both federal and private, you could always choose to refinance your student loans. Student loan refinancing allows you to customize your repayment term to be shorter, longer, or the same — while getting a lower rate to save money on interest costs.

Credit Card Debt Piling Up?

Outside of your repayment term, another major factor is if you have extra funds to pay down your student loan balance. If you increase your monthly payments beyond what’s stated on your bill, or you use cash windfalls like tax returns and work bonuses to put toward your principal, you can pay off your loans much faster.

How does the monthly payment on $200k in student loans compare to $100k?

The total amount of your student loan payments — whether you have $100k or over $100k in student loans — will depend on your own unique loan situation. Some key factors that impact your monthly bills are:

- How many total loans and payments you have

- What your interest rate is and how much in interest you pay each month

- What the length of your repayment term is and how many months you have to pay off your debt

How to pay off $100k+ in student loans

Ready to learn how to pay off $100k in student loans or $200k student loan debt?

If you want to eliminate your debt as quickly as possible and are in a position to do so, there are a few different options to consider. Here are some of our top choices (note: this can also work if you’re trying to figure out how to pay off $200k in student loans quickly).

1. Student loan refinancing

Whether you have federal or private student loans, you may be able to refinance them with a private lender. Student loan refinancing involves replacing your current loans with one new loan.

Each lender typically has a range of interest rates you can qualify for, and if your credit and income are in great shape — or you have a creditworthy cosigner — you may be eligible for an interest rate that’s lower than what you’re currently paying.

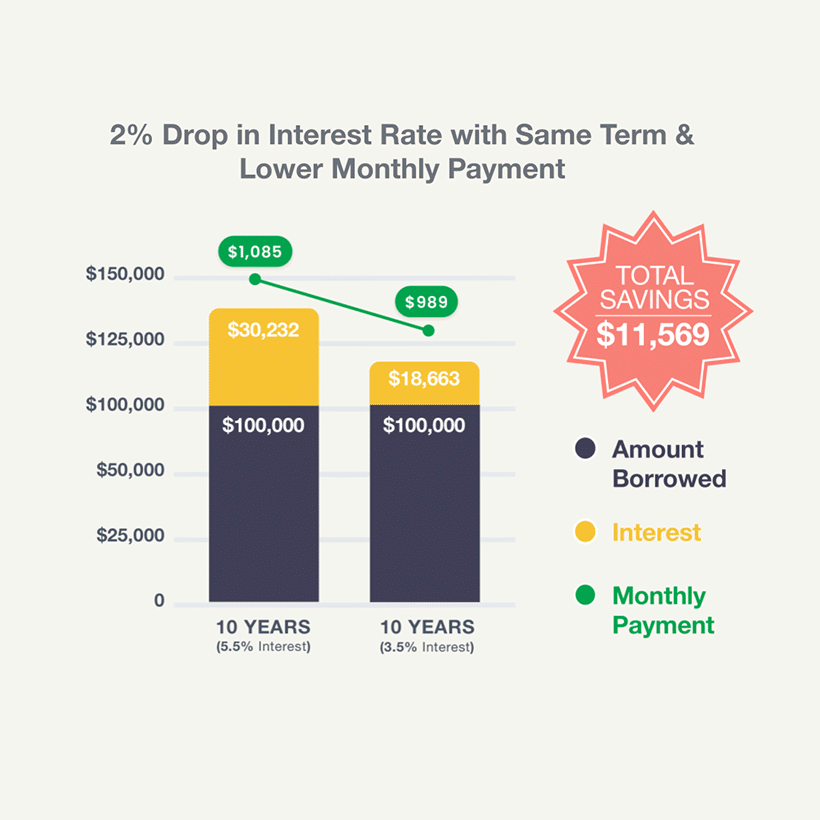

For example, let’s say you’re wondering how to pay off $100K in student debt with a 10-year repayment term and an average interest rate of 5.5%. If you qualify for a 3.5% interest rate with a private lender, refinancing would lower your monthly payment by $96, and save you a whopping $11,569 in interest.

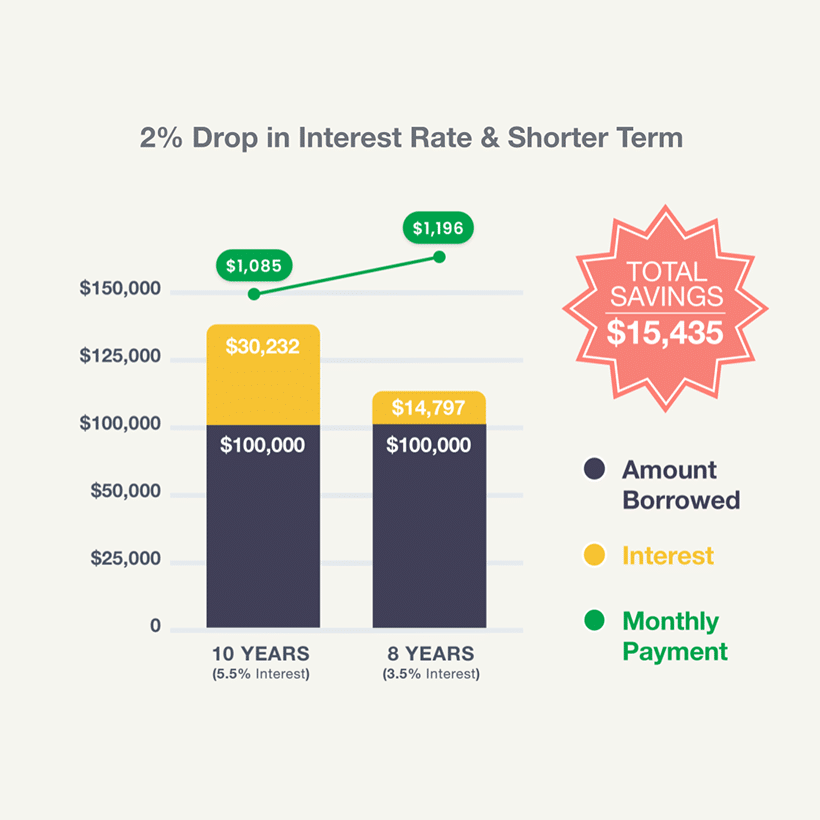

If you want to pay down your debt faster, you can also choose a shorter repayment term. For example, let’s again say you’re trying to figure out how to pay off $100k in student loans. Your repayment term is 10 years, and you have an average interest rate of 5.5% — same as the example above. In this scenario, your monthly payment would be $1,085.

If you choose an eight-year repayment term instead and qualify for a 3.5% interest rate, your monthly payment would increase only to $1,196 — but you’d save $15,435 in interest.

Note that you can also choose a longer repayment term with refinancing, which will lower your monthly payment. But doing so will also increase the amount of interest you pay over the life of the loan.

If you’re considering refinancing, be sure to compare lenders using Purefy’s rate comparison tool. With just a little information about yourself and how much you owe, you can compare multiple refinancing lenders, along with their rate offers for you, in one place.

All in all, student loan refinancing can be one of the most effective solutions for how to pay off $100k in student loans or $200k student loan debt.

See How Much You Can Save

View Details

Collapse

Step 3: See How Much You Can Save

$15,310

Lifetime Interest

Savings

$1,018

New Monthly

Payment

$128

Monthly

Savings

| Current Loan | New Loan | Savings | |

|---|---|---|---|

| Rate | 6.7% | 4.2% | 2.5% |

| Lifetime Interest | $37,520 | $22,210 | $15,310 |

| Monthly Payment | $1,146 | $1,018 | $128 |

Like what you see? Check your actual prequalified rates from the industry’s top lenders in just 2 minutes or less.

2. Student loan repayment assistance programs

Depending on your field of expertise, there are several loan repayment assistance programs available that can help you get a large chunk of your debt paid off within just a few years. For example, several branches of the Armed Forces provide assistance if you commit to a certain number of years of service.

There are other public programs available for public defenders, teachers, doctors and nurses, and more. Some are offered through the federal government, while others are provided on the state or local level or through nonprofit organizations.

You may even be able to get repayment assistance from a private employer, though the benefit amount is typically lower than what you’d get through a government- or nonprofit-sponsored program.

Do you qualify for student loan refinancing?

Find out if you prequalify with vetted student loan refinance lenders to see how much you could save. Many lenders offer lower rates to borrowers with graduate degrees.

Takes 2 minutes • No impact on credit

Regardless of what your profession is, take some time to research student loan repayment assistance programs to see if you qualify and can meet the requirements.

3. Extra monthly student loan payments

If you don’t qualify for a loan repayment assistance program and can’t get a lower monthly payment through refinancing, your best bet may be to pay more than what you’re required to every month.

This works best if you can afford to make the extra payments. As you can see from our previous examples, though, student loan payments on a six-figure balance are in the thousands of dollars. So take some time to consider your budget and other financial goals before you start adding more to your student loans every month.

If high credit card debt is affecting your ability to repay your student loans faster, you could also consider consolidating your credit cards with a low-interest personal loan. We recommend that you compare personal loan rates with Purefy’s free tool to see how much you could save. Many people can significantly lower their monthly payment while paying off their debt faster at the same time.

Compare Personal Loan Offers

Compare Personal Loan Offers

How to pay off $100k+ in student loans more affordably

In an ideal world, you’d be able to figure out how to pay off $100k in student debt fast (or $200k, depending on how much you owe).

But if your budget is making it hard to keep up with your monthly payments and you’re not in a place where you can qualify for refinancing or loan repayment assistance programs, there are some options available to make your life a little easier.

Income-driven repayment plans

If you have federal student loans, you may be able to get on an income-driven repayment plan, which can make it easier to meet your monthly payments.

There are four income-driven repayment plans available to federal loan borrowers, and all of them reduce your monthly payment to 10% to 20% of your discretionary income, which is calculated based on your income, where you live, your family size and the plan itself.

These plans also extend your repayment term to 20 or 25 years. While that’s not ideal if you’re trying to figure out how to pay off $100k in student loans fast, it can provide much-needed assistance if finances are tight.

Also, keep in mind that once your repayment term is over, the U.S. Department of Education will forgive your remaining balance.

Just keep in mind that if you get on an income-driven repayment plan, your monthly payment may drop significantly, but you’ll also pay a lot more in interest.

For example, let’s say you’re wondering how to pay off $200k in student loans with an average interest rate of 5.7%, $150,000 in annual income and a four-person household in Texas.

Assuming 3% growth with your annual income, your monthly payment would drop from $2,190 to $943 under the Pay As You Earn plan the first month. Note, however, that your monthly payment would increase over time as your income grows, and your last monthly payment would be $1,715. You’d pay $47,499 more in interest, but $80,901 of your balance would be forgiven after 20 years, which would be taxed at your regular income tax rate.

Of course, keep in mind that that’s just a projection. The actual numbers will vary based on how much you owe, your actual interest rates, where you live, and your actual income growth. But it should give you an idea of what to expect.

Also, keep in mind that private student loans typically don’t come with income-driven repayment plans, so you may need to contact your lender directly if you’re struggling to make your payments.

Student loan forgiveness programs

Federal loans can also qualify for certain loan forgiveness programs, including Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness. If you meet the qualifications for those programs, you may be able to get a large portion of your debt forgiven.

The programs aren’t quick fixes, however. With PSLF, you need to commit to working for a government or nonprofit organization for at least 10 years, and if you’re a teacher, it’s at least five years. Also, there’s a cap of $17,500 on the teacher loan forgiveness program (and only certain teachers qualify for that amount).

How to pay back $100k in student loans the right way

There’s no one-size-fits-all solution to paying off $100k in student loans or even paying off $200k in student loans, but there are several options available to help you save money or get some relief on your monthly payments.

To find the right path for how to pay $100k in student loans or how to pay off a $200k student loan, take a look at your current financial situation, as well as your future goals.

While paying off your debt more quickly is nice, it could get in the way of other important financial goals, such as saving for retirement or paying off high-interest credit card debt.

Also, think about how your decision will affect you in both the short and long terms. Refinancing federal loans with a private lender could save you money on interest, but you’d also lose access to income-driven repayment plans, loan forgiveness programs and generous deferment and forbearance options through the Department of Education.

As you consider your circumstances and your options carefully, it’ll be easier to find the best solution for how to pay off over $100k in student loans.

Interested in Student Loan Refinancing? Compare rates from top-rated lenders and see how much you could save.

Checking your rates takes 2 minutes and has no impact on credit.