Wouldn’t it be great if you could get private student loans without a cosigner? Well, it may be possible if you meet certain financial or academic criteria, and we’re here to walk you through the process.

As a student today, finding ways to finance your education is critical to your long-term success. Over 70% of undergraduate students and 54% of grad students graduate with some form of student debt. And for those with professional degrees, like doctors and lawyers, it can be as high as 84%.

Unfortunately, you may not have a person in your life who can cosign a student loan and obtaining a loan on your own with little credit history can be difficult. Read on to explore our strategies to get the best private student loans without a cosigner.

Federal vs Private Loans

While private loans can be beneficial to bridge any funding gaps, they should only be used after you have exhausted all federal options, as well as gifts, grants, and scholarships.

Why use federal loans first?

Federal student loans generally offer lower rates than those offered by private lenders. And since federal loans are guaranteed by the U.S. Department of Education, they have a ton of great benefits and protections, including:

- No credit history or cosigner required

- Lower fixed rates

- Interest is accrued until graduation for subsidized federal loans

- Forbearance and deferment options

- Multiple repayment options, including income-driven repayment plans (for example, Pay As You Earn Repayment Plan and Revised Pay As You Earn Prepayment Plan)

- Loan forgiveness for certain qualified careers in the public sector, including healthcare, public service, and teaching

- Repayment grace periods

- Loan consolidation

However, there are annual limits as to how much you can borrow from the federal loan program. For undergraduate students, the annual limit is $12,500 each year, with a maximum of $57,500 in total.

For graduate students, the limits are $20,500 annually and $138,500 in total.

Once you have reached these limits and exhausted other options, private student loans are the next choice.

Eligibility Criteria for the Best Private Student Loans Without a Cosigner

To find the best private student loans without a cosigner, you’ll need a few things in your toolbox, including:

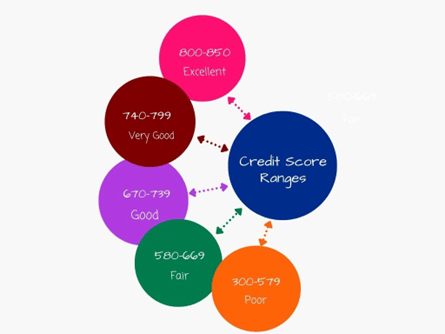

- Your credit score and credit report — This is your financial calling card and is used not only by financial institutions to determine interest rates, but also by companies evaluating job applicants, by rental companies when making housing decisions, and more.

If you don’t know your credit score and want to check it out along with your credit history, you are entitled to one free credit report per year from each of the three credit bureaus. You can obtain your free credit reports here.

If your credit report shows missed payments or if you have very little credit history, there are ways to improve your score quickly to qualify for better interest rates on new or refinanced loans. Here are a few ways to boost your credit score:

- Pay your bills on time.

- Get a credit card to start building a credit profile. Just be sure to manage it well.

- Pay your credit card balances in full each month.

- Check your credit report for errors or omissions. Each credit bureau has a process to dispute errors that can make a big difference to your score.

- Don’t open too many accounts at once or carry maxed out balances on your credit cards.

- Your Income — You’ll need to demonstrate that you earn income sufficient to repay the loan. That can be tough when you are a full-time student. Be sure to consider any part-time income, contract work or work-study income, and miscellaneous income, like alimony (if that is something you have).

- Your Debt-to-Income Ratio (DTI) — Private lenders want to see that you don’t owe more than you can pay each month and that is easily determined by looking at your outstanding monthly payments for fixed costs (such as rent, credit card payments, and car loans) compared to your total gross income. Easily figure out your DTI by using our debt-to-income ratio calculator.

Income and Credit Requirements from Some Top Lenders

Let’s take a look at some of the eligibility requirements used by several of the top-tier student loan lenders:

Ascent Credit-Based Loans

- Credit score – 680 minimum

- At least 2 years of good credit history

- An annual income of $24,000

- Must be a U.S. Citizen, permanent resident, or have Deferred Action for Childhood Arrival (DACA) status

- Enrolled at least half-time

Ascent Outcomes-Based Loan

- Available to Juniors and Seniors without a credit score who have a 2.9+ GPA

- Must be enrolled full-time or graduating within the next 9 months

- Must meet your school’s satisfactory academic performance (SAP)

- Must be a U.S. Citizen, permanent resident, or have Deferred Action for Childhood Arrival (DACA) status

College Avenue

- Credit score – mid-600’s, plus solid repayment history

- Must be a U.S. citizen or permanent resident

- Must have steady income

- Must pass a credit check

- Enrolled at least half-time

Earnest

- Credit score – 650 minimum

- Enrolled at least half-time

- Enrolled in a Title IV-qualified school

- At least 3 years of good credit history with no collections or bankruptcy

- An income of at least $35,000 annually

The 4 Best Companies for Private Student Loans

Our Top-Rated Picks for 2023 Offer Low Rates and No Fees

Option to skip a payment once a year

In-school deferment available if you return for another degree

Optional $25 payment plan during school to reduce interest after graduation

1% Cash Back Graduation Reward program

Fixed Rate

Variable Rate

Fixed Rate

Variable Rate

Compare Student Loan Options Without a Cosigner

Without a cosigner, you’ll either need a good credit score and steady income, or you’ll need to pursue an outcomes-based loan like Ascent’s. The next step is to compare lenders to get an idea of what rates you can qualify for with each lender.

Let’s weigh the pros and cons for some top lenders in the student loan space.

Ascent

Loan Limit: $200,000

Terms: 5, 10, 15, or 20 years

Offers financial hardship deferments of up to 24 months

Pros

- Offers both fixed and variable terms.

- Loans considered on credit and non-credit criteria, such as school, program, and upper classmen can qualify on ‘future income’ with no credit or cosigner.

- Offers a 0.25% to 1.0% discount for autopayment.

- Offers a graduation reward or bonus equal to 1% cash back if you graduate within five years.

Cons

- Not available if you are enrolled less than half-time.

- Loans without a cosigner come with significantly higher rates than Ascent’s cosigned options.

College Avenue

Loan Limit: $150,000 for undergraduate degrees

Terms: 5 to 15 years

Discretionary forbearances awarded on a case-by-case basis

Pros

- Offers 11 different options for repayment terms between 5 and 15 years.

- Allows biweekly payments through autopay to increase speed of payoff.

- Offers $150 cash bonus when you graduate.

- Offers fixed and variable rate loans.

- Offers a well-reviewed app for mobile use.

Cons

- No clear forbearance policy and no deferments available.

- Repayment terms max out at 15 years, which is shorter than most private lenders.

- Loan servicing is handled by a third party.

Earnest

Loan Limits: up to 100% of the cost of attendance

Terms: 5 to 20 years

Offers deferment and forbearance options up to 12 months, plus multiple repayment options

Pros

- Offers customizable repayment plans, including extra payments through autopay to save money.

- All loan servicing done in-house from start to finish.

- You can skip a payment once per year.

- Offers a 9-month grace period post-graduation.

- No late fees.

Cons

- No weekend customer service support.

- No mobile app available as of yet.

Checking rates on a Student Loan Marketplace Website

The next step is to check rates with premier private lenders to see if you are eligible for a private student loan without a cosigner.

Comparing rates is simple — you can use Purefy’s rate comparison tool to explore your options in minutes. All you need to do is enter your information and undergo a soft credit pull (which does not affect your credit score) to receive real-time prequalified rates from private lenders.

You can compare offers to see which deal makes the most sense for you before applying. Just remember to keep your tuition deadlines in mind, since full disbursement to your school can take anywhere between a few weeks to a month or two.

Remember, there’s no cost or obligation to use a quote engine like Purefy and all lenders are fully vetted with no application or origination costs.