When it comes to paying for college, federal student loans are often a student’s first choice thanks to their low interest rates and valuable repayment benefits. Unfortunately, most federal loans have strict limits on how much can be borrowed, so you may have also taken out private student loans to finish paying for your degree.

According to Saving for College, two-thirds of bachelor’s degree recipients graduated from college with student loan debt in 2019, with an average balance of $29,900. While the majority of students relied on federal student loans to pay for school, 11% took out private student loans on top of federal aid, and about 6% exclusively used private loans to finance their education.

When those graduates started repaying their loans, the average private student loan debt payment was $383 per month.

Are you part of the 11% of graduates with private student loans?

Use our rate comparison tool today to see how much you can be saving. There’s no reason to wait with current rates at all-time lows.

Takes 2 minutes • No impact on credit

Private student loans aren’t eligible for income-driven repayment plans or other flexible repayment options like federal loans. If you’re sick of paying that amount every month and want to learn how to pay off student loans faster, here’s what you need to know about managing your debt.

How to pay off student loans faster

If you want to get rid of your student loan debt ahead of schedule, there are two core strategies: making larger payments and student loan refinancing.

1. Make larger monthly payments

To speed up your debt repayment, you can pay more than the minimum required payment each month. When you pay more than the minimum, more of your payments go toward the loan principal rather than the interest that accrues on your debt. Over time, you cut down on interest charges, saving both time and money.

You can make lump-sum payments — meaning you pay a large chunk all at once — or you can increase your monthly payments by a set amount. How much of a difference could extra payments make? Let’s look at an example.

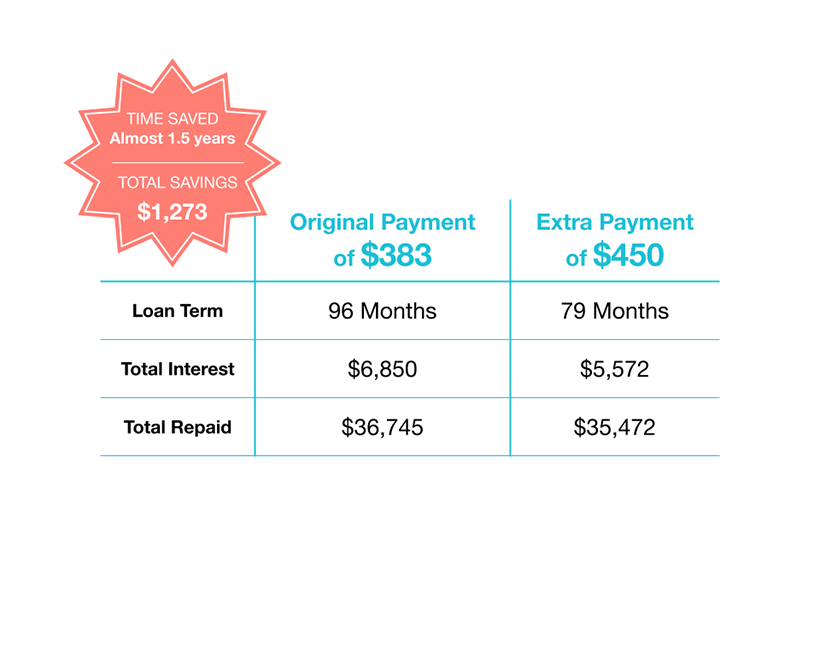

If you had $29,900 in student loans at 5.3% interest, your monthly payment would be $383 per month. It would take you eight years to repay your loans, and your total repayment would be $36,745.

If you increased your payment to $450 per month — a difference of just $67 — you would pay off your loans 17 months early. And, you’d repay just $35,472. You’d save $1,273 in interest charges.

- Use extra windfalls: If you get windfalls from a tax refund, a bonus from work, or gifts, use that cash to pay down your loans.

- Cut your expenses: While you’re paying off your loans, reduce your living expenses and eliminate extras like dining out, cable, and subscriptions to free up money for your student loan payments.

- Pick up a second job or side gig: If possible, work a second job or a side gig during the evenings or on the weekends. You could work at a coffee shop, retail store, deliver groceries, or even walk dogs for additional income.

- Sell unused stuff: If you have unused electronics, books, clothes, or accessories in your home, sell them on eBay, Poshmark, or DeCluttr for cash.

2. Refinance your student loans

If you want to pay off your loans faster, another tried-and-true option is to refinance your student loans.

With this strategy, you apply for a loan with a private lender for the amount of your existing debt. The new loan will have different terms, including interest rate, monthly payment, and loan length. Depending on your credit, you may qualify for a loan with a lower interest rate to save money.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

To ditch debt quickly, it makes sense to opt for a shorter loan term than you currently have. In general, shorter loan terms qualify for the lowest interest rates. While you’ll have a higher monthly payment with a shorter term, you’ll save more money over the length of your repayment term. Ultimately, you’ll be out of debt much sooner while paying less total interest.

What if you can’t afford to increase your payments? If you’re wondering how to lower your student loan payment without having to lengthen your loan term, refinancing your private student loans can be a smart solution. By reducing your interest rate, you can lower your payment but keep to the same repayment schedule.

Read More: Should You Refinance Private Student Loans?

For example, if you refinanced the same loans as mentioned above and qualified for an eight-year loan at 3.5% interest, your monthly payment would drop to $358 — a savings of $25 per month. Over the length of your repayment term, you’d repay just $34,324.

Even with a smaller monthly payment, you’d pay off with your loan within eight years and save $2,421 in interest charges.

| Original Loan | Refinanced Loan | |

| Loan Balance | $29,900 | $29,900 |

| Loan Term | 8 Years | 8 Years |

| Interest Rate | 5.3% | 3.5% |

| Monthly Payment | $383 | $358 |

| Total Interest | $6,845 | $4,424 |

| Total Repaid | $36,745 | $34,324 |

Why are student loan refinancing rates so low right now?

Private lenders, including student loan refinancing lenders, typically base their interest rates on the London Interbank Offered Rate (LIBOR) or Federal Reserve rates. When these rates go down — as they have done in the past few months — private lenders decrease their rates, as well.

When the economy is in decline, those LIBOR and Fed Rates often go down, and private loan rates along with them. For borrowers wondering how to get a lower student loan payment or lower interest rate, it’s an excellent time to refinance their loans to take advantage of low rates.

Read More: Why Student Loan Refinance Rates Are Insanely Low Right Now

You can use Purefy’s Compare Rates tool to get quotes from top student loan refinancing lenders at the same time with one fast form — with no impact to your credit score.

If you have any questions during the refinancing process, you can also contact our team of award-winning loan advisors or schedule a free student loan refinance consultation.