Finding the right lender to refinance your student loans with can feel like a daunting task. With so many options available, you want to make sure you get the best deal while also setting yourself up for success with your student loan repayment plan.

Education Loan Finance (ELFI) is one of the many student loan refinancing lenders to consider. In this ELFI student loan refinance review, you’ll learn about the lender, what sets it apart from the rest, and whether it’s the right path forward for you.

ELFI student loan refinance review: Company overview

ELFI is owned by Tennessee-based SouthEast Bank and unlike some other student loan refinance lenders, which also offer other financial products and services, it only specializes in private student loans and student loan refinancing.

ELFI was launched by SouthEast Bank in 2015, and by 2020, it surpasses $1 billion in student refinance loans. The lender offers competitive interest rates and some features that aren’t available with all lenders. But there are also some drawbacks that may make you think twice, especially if you’re thinking about heading back to school.

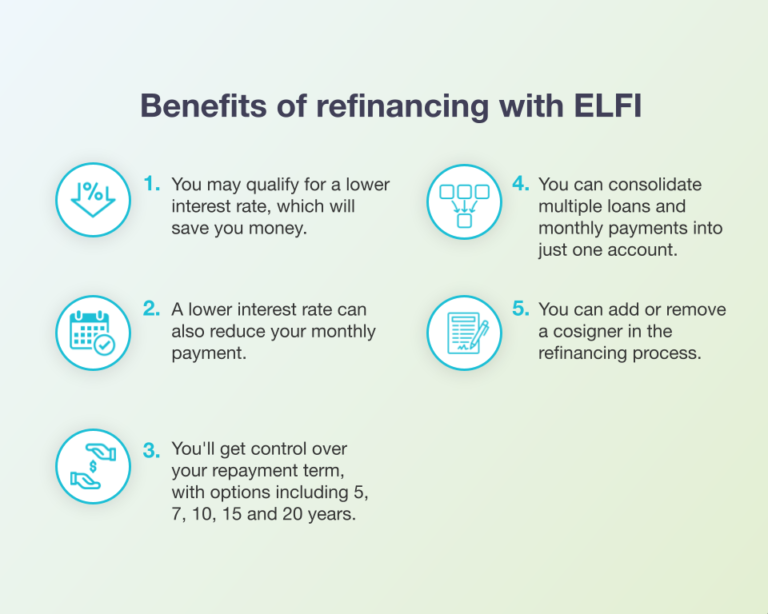

Benefits of ELFI student loan refinancing

Many of the benefits you can get from refinancing your student loans with ELFI apply to other student loan refinancing lenders:

Unique features of ELFI student loan refinancing

ELFI also offers some refinancing benefits that you can’t get everywhere else. One of them is the ability to refinance Parent PLUS Loans, with the option to refinance them in the child’s name. The only catch is that parent refinance loans are limited to 5, 7 or 10-year repayment terms.

You’ll also be assigned a personal loan advisor, who will guide you throughout the refinancing process and answer any questions you might have along the way.

Finally, unlike some other lenders, ELFI doesn’t limit how much you can refinance, so it’s an excellent option for borrowers with huge student loan balances.

Other key features to know about ELFI Student Loan Refinance

Every lender has a different set of features, so it’s important to look at more than just the interest rate when you compare student loan refinance rates:

- Loan minimum: ELFI doesn’t have a maximum loan amount. But its minimum loan amount is $10,000. If you have a lower loan balance than that, you will need to seek out a different lender.

- Interest rates: Like many other lenders, ELFI offers both fixed and variable interest rates, so it’s important to make sure you know what you’re getting yourself into. Fixed interest rates don’t change throughout the life of the loan, but they are higher than variable rates at the start. In contrast, variable rates start lower but can increase over time as market rates change.

- Forbearance: If you have a hard time making your monthly payments, ELFI may offer forbearance of up to 12 months.

- Cosigner release: If you apply with a cosigner, many student loan refinance companies offer a cosigner release program, which allows you to remove your cosigner if you meet certain conditions. Unfortunately, ELFI doesn’t offer one of these programs, so you’d need to refinance again to get a cosigner off your loan.

- School deferral: Once your payments begin, you can’t get a deferment if you return to school.

Who should refinance student loans with ELFI?

ELFI student loan refinancing is best for people with good credit scores and high balances. The lender offers low interest rates, with a cap of 9.95%, so you know you’re never going to go higher than that.

It can also be worth considering if you have Parent PLUS Loans and want to refinance them for yourself or to transfer your loans to your child graduate.

The lender offers refinancing in all 50 states and Puerto Rico, so you don’t have to worry about not qualifying based on where you live. Other eligibility requirements include:0

If you’re not sure whether you qualify based on certain criteria, you can get prequalified with ELFI, which doesn’t require a hard credit check.

How to compare ELFI student loan refinance rates

ELFI student loan refinancing can be a great choice for some borrowers, but not for everyone. So it’s important to shop around and compare the best student loan refinance rates and other features before you proceed.

Like ELFI, most other student loan refinancing companies offer a prequalification process. But going through this process with each individual lender can be time-consuming. The Purefy rate comparison tool offers the opportunity to get prequalified with multiple lenders at once.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

This comparison not only saves you time but also allows you to compare your options side by side for more convenience and efficiency.

Again, it’s important to look at more than just the interest rates. Consider other features that might make working with a certain lender a better experience for you.

ELFI student loan refinancing: The bottom line

ELFI is a legitimate student loan refinancing company that offers competitive interest rates and excellent features. It’s especially worth considering if you have a large student loan balance.

However, it might not be the best fit if you’re thinking about returning to school in the future. It may also not be the right choice if you don’t meet certain eligibility requirements the lender has set.

Make sure you shop around before you pull the trigger on student loan refinancing to make sure you get the best deal for your situation.