Federal and private student loans often come with a repayment term of 10 years or longer. But even though you have that long to pay back your college debt, there are advantages to paying it off ahead of schedule.

In this quick guide, you’ll learn how to pay off student loans in 5 years or even less, and if it makes sense for your budget and financial goals.

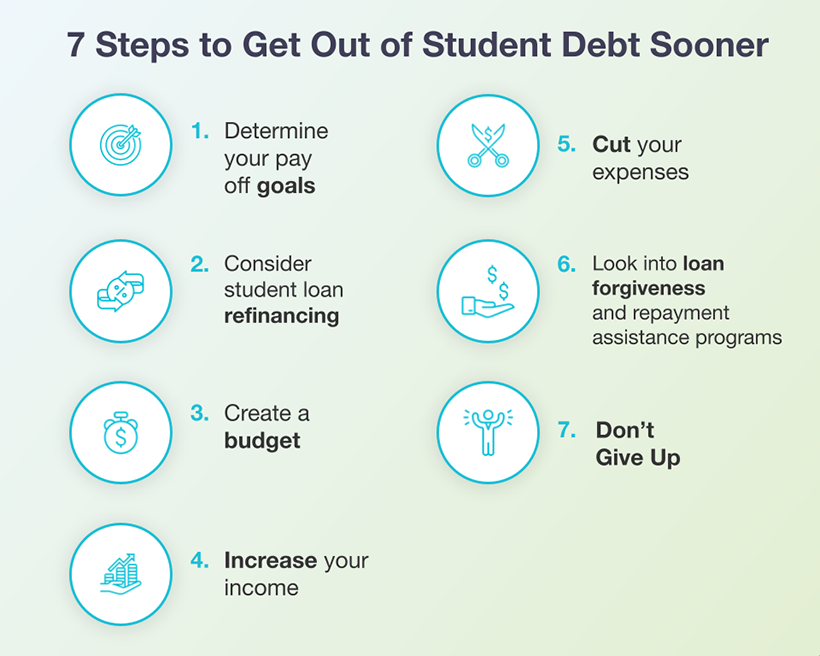

How to pay off student loans in 5 years or less

Paying off student loans in 5 years or less is no easy task, but depending on your financial situation, it may be doable. Even if you can’t manage meeting that timeline, you may still be able to save money on interest and become debt-free sooner than expected.

1. Determine your pay off goals

You may be tempted to jump in and start increasing your monthly payments, but your repayment plan could be much more effective if you take a step back and look at your bigger financial picture.

To start, consider your goals. Do you want to pay off student loan debt in 5 years or less? Or do you simply want to get rid of it a little sooner than planned?

Thinking about a dream vacation? Or maybe buying a home?

Refinancing to a lower rate today may get you on track to save thousands over the life of your loan, and allow you to move on to what’s next.

Takes 2 minutes • No impact on credit

As you think about what could work for your budget, focus on why you want to pay off your debt early to help you maintain motivation. Maybe you want to buy a home, have kids, or go on a dream vacation. Or you may just want to enjoy the relief of not carrying that burden everywhere you go. Whatever it is, make it concrete so you have something to look forward to.

2. Consider student loan refinancing

Before you get into the nitty-gritty of budgeting, think about whether you could save money and meet your pay off goals by refinancing your student loans.

If you qualify, student loan refinancing may allow you to get a lower interest rate than what you’re already paying. You’ll also have the option to choose a new repayment term. So if paying off student loans in 5 years is your goal, you can request a loan with a 5-year repayment term instead of one that matches your current repayment term.

Once you do that, you won’t have much extra work to achieve your goal — simply make your new payment every month as usual.

Before you pick a lender, though, take some time to shop around to compare rates and terms from several lenders. To make this process simple and quick, use Purefy’s rate comparison tool which provides rate offers from multiple lenders in one convenient place — with one easy form.

If you don’t qualify for student loan refinancing or you wouldn’t be able to afford the higher monthly payment that’s associated with a shorter term, skip this step and move onto the next one.

The 2 Best Companies to Refinance Student Loans

Our Top-Rated Picks for 2024 Offer Low Rates and No Fees

3. Create a budget

Once you have an idea of when you want to be debt-free and whether refinancing can help you do it, set up a budget to help you achieve your goal.

Use an online student loan prepayment calculator and punch in the numbers for your particular situation, and it will tell you exactly how much you need to pay in addition to your regular monthly payments to make it happen.

Once you have this number, take a look at your income and expenses. Then determine how you need to manage your money going forward to ensure that you’re paying what you need to on your college debt.

4. Increase your income

If you can’t manage your desired payment every month while covering all your other necessary expenses, search for ways to earn some additional funds to make it possible.

This may include taking on a second job or working overtime at your current one, or you could look into side job opportunities to make extra money. Whatever you decide to do, avoid the temptation to use the money for other things — unless, of course, you can already afford your desired monthly payments but want a little extra spending money or more cash to set aside in savings.

5. Cut your expenses

Cutting back on certain areas of your budget isn’t always possible, but it’s still worth checking to see if it’s an option. Take a look at the budget you created and look for common expenses that you don’t need to incur.

For example, you may want to cut back on going out with friends and invite them to your place instead. Or look at your recurring subscriptions to see if you can consolidate some entertainment options, switch cell phone carriers, or get rid of a subscription you don’t really need.

Again, if your budget is already barebones, this step will be difficult. But if you can manage to cut even a little each month in other areas, it can make a big difference over several years on your student loans.

6. Look into loan forgiveness and repayment assistance programs

If you have federal student loans, you may have access to a handful of loan forgiveness programs and several loan repayment assistance programs. These programs are typically based on the type of job you have, so search for options based on your chosen career.

Most of these programs are run by government agencies and nonprofit organizations, and some offer up to tens of thousands of dollars in aid. However, some private employers also provide repayment assistance. Check with your employer to see if it offers that as an employee benefit. If not, keep that benefit in mind if you’re ever in the market for a new job.

7. Don’t give up

Figuring out how to pay off student loans in 5 years instead of the standard 10-year repayment plan can be exciting. But that’s still a long time to stick to your plan, and it can be easy to fall off the wagon at some point.

It’s important to evaluate your progress at least once or twice a year to make sure you’re still on track. Also, it’s easy to set goals, but you may find with this process that you need to make some adjustments along the way to make your goals more reasonable.

The bottom line

If you’re interested in learning how to pay off student loans in 5 years or less, it is possible with these steps. That said, the process is still lengthy. So it’s important to create a plan based on your goals and financial situation to make sure your plan is doable.

As you put your plan in motion, take time periodically to check-in to see if you’re still on track, and make adjustments if needed to achieve your pay off goals.

Need help with a personalized plan for your student loans?

At Purefy, our award-winning experts are ready to guide you through your best options to save.

Talk now 800-491-9310

Kelli

Shannon

Evan

Cassie